Date | Open price* | Upper Price | Lower Price | Close price** | Vol |

|---|

|

* Earliest data in range (UTC time)

** Latest data in range (UTC time)

About UK100 historical price data

The UK100 price history tracker allows cryptocurrency investors to conveniently monitor the performance of their investments. You can easily view the opening, highest, and closing prices of UK100 over time, as well as the trading volume. In addition, you can instantly check the daily percentage change to easily identify days with higher volatility.

According to our UK100 price history data, its value surged to an all-time high of over $14,248.49 in 2026-02-11. On the other hand, the lowest point in the UK100 price trajectory (often referred to as the “UK100 all-time low”) occurred in 2026-02-11. Anyone who purchased UK100 during that period would currently enjoy an impressive profit of $14,248.49.

By design, the total supply of UK100 will reach --. As of now, the circulating supply of UK100 is approximately --.

All prices shown on this page come from trusted data provider LBank. When reviewing your investments, it is recommended not to rely on a single data source, as values may differ between providers.

Our historical Bitcoin price dataset includes 1-minute, 1-day, 1-week, and 1-month data (open/high/low/close/volume). These datasets have been rigorously tested to ensure consistency, integrity, and accuracy. The design is specifically for trading simulations and backtesting, available for free download and updated in real time.

UK100 historical data examples

Here are some uses of UK100 historical data in UK100 trading

Technical analysis:

Traders use historical data to analyze trends and movements in the UK100 market. They use charts and other visual tools to identify trends and determine when to enter or exit the market. One way to gain an advantage in this dynamic market is to visualize and analyze historical market data. To achieve this, historical data can be stored in GridDB and analyzed using Python scripts with various libraries, such as Matplotlib, Pandas, Numpy, and Scipy for data visualization.

Predicting UK100 price based on historical data:

Historical data can also be used to predict future market trends. By analyzing past market behavior, traders can identify recurring patterns and make informed predictions about the direction of the UK100 market. By using LBank’s UK100 historical dataset, traders can obtain minute-by-minute data such as open, high, low, and close prices for UK100. These data can then be used to define and train price prediction models, helping users make informed trading decisions.

Risk management:

By obtaining historical data, traders can assess the risks of investing in UK100. They can also determine the volatility of UK100, allowing them to make sound investment decisions.

Portfolio management:

Historical data is also useful in portfolio management. By tracking investments over the long term, traders can identify underperforming assets and adjust portfolios to maximize returns.

Training UK100 trading bots:

In addition, users can choose to download UK100 historical cryptocurrency OHLC (open, high, low, close) data to train their own UK100 trading bots, achieving outstanding performance in the market. With these tools and resources, traders can deeply study UK100’s historical data, gain valuable insights, and potentially improve their trading strategies.

How to analyze UK100 candlestick chart data

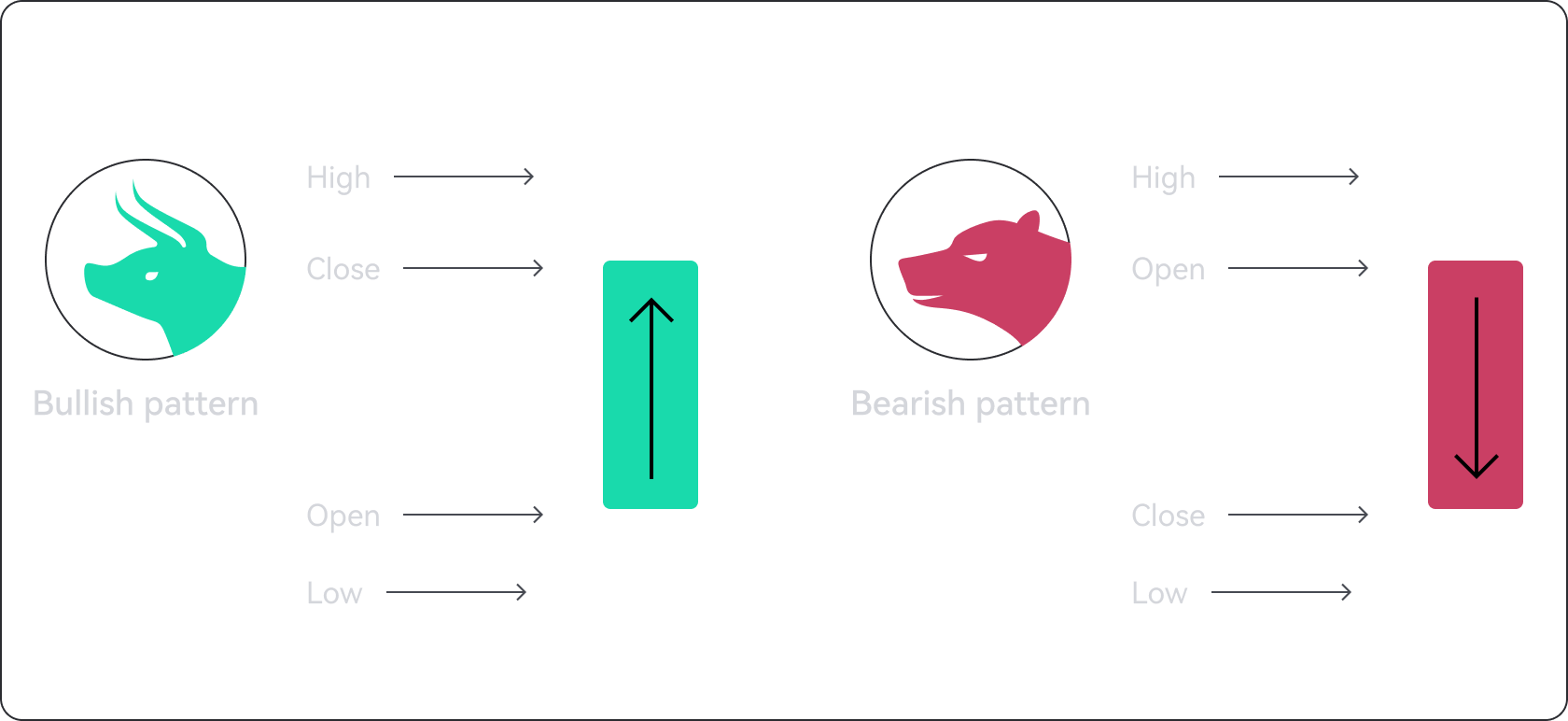

UK100 candlestick charts display time on the horizontal axis and price data on the vertical axis, similar to line and bar charts. A candlestick may have two different colors: green or red. A green candle indicates a price increase during the considered period, while a red candle indicates a price decrease.

The simple structure of candlestick charts can provide users with a wealth of information. For example, technical analysis may use candlestick chart data to identify potential trend reversals.

According to UK100 historical data, when the UK100 market shows bearish or bullish trends, conservative investors may choose to use capital-protected products such as Flexible and Locked to capture the trend at that time. When UK100 is in a sideways trend, using Open Futures and selecting a bullish product to take advantage of a slight upward trend, or choosing a bearish product to profit from a mild downward trend, may lead to better performance.  uk100(UK100)

uk100(UK100)

uk100(UK100)

uk100(UK100)