Ripple just unlocked access to the entire European Union. On February 2, Luxembourg's financial watchdog gave the company full approval to operate as an Electronic Money Institution across all 27 EU member states.

This development represents a gateway that lets Ripple offer payment services and digital asset solutions to banks and businesses throughout Europe without needing separate permits in each country.

What’s Happening with Ripple?

Luxembourg's Commission de Surveillance du Secteur Financier (CSSF) granted Ripple the final green light after the company met all required conditions. Ripple had received preliminary approval back in January, but now the license is official and active.

An EMI license lets companies issue electronic money and handle payment processing. But the bigger win here is what regulators call "passporting rights." Get approved in Luxembourg, and you're automatically cleared to do business across all 27 EU countries.

Ripple won't need to file separate applications or wait months for approval in France, Germany, Italy, or anywhere else in the bloc.

For Ripple, this means they can now onboard European clients - banks, payment providers, businesses - and offer them blockchain-based payment rails using XRP and their RLUSD stablecoin.

Cassie Craddock, who runs Ripple's UK and European operations, said Europe has always been a "strategic priority" for the company. The approval puts them in position to help European financial institutions move toward faster, cheaper cross-border payments.

Image via X

Why This Matters

This license builds on momentum from last month when Ripple secured similar approvals in the UK from the Financial Conduct Authority. The company now holds more than 75 licenses worldwide, making it one of the most heavily regulated crypto firms operating today.

That matters because institutional clients—the banks and corporations Ripple wants to work with—demand regulatory clarity before they'll use blockchain technology. Each new license removes another barrier to adoption.

In Europe specifically, where regulators have been rolling out comprehensive crypto rules under the MiCA framework, having an EMI license shows Ripple can meet high compliance standards.

Market Response & XRP Price Context

XRP's price showed a modest bump after the news, climbing nearly 3% to around $1.60. That's a far cry from the $2.41 peak it hit on January 6, though. The token has dropped roughly 31% since that high, caught in the same downdraft that's hit most major cryptocurrencies recently.

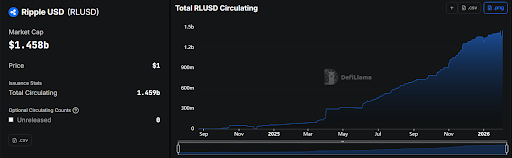

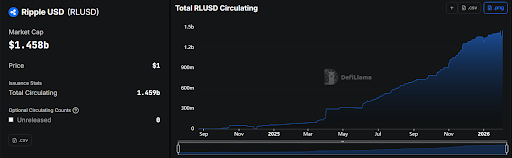

Interestingly, Ripple's RLUSD stablecoin saw stronger growth, with its market cap rising to $1.46 billion. The stablecoin jumped 33% on the XRP Ledger following the regulatory news, suggesting growing confidence in Ripple's ecosystem beyond just the XRP token itself.

Image via DefiLlama

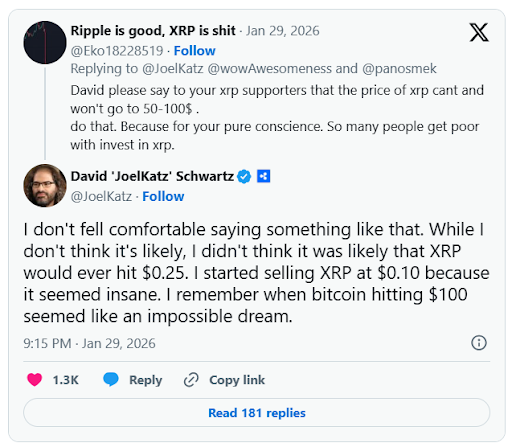

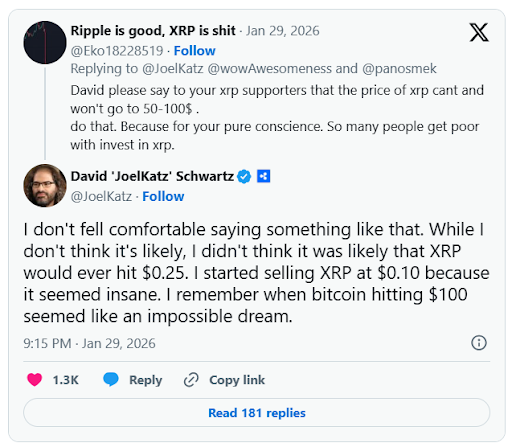

Meanwhile, Ripple's Chief Technology Officer David Schwartz recently weighed in on speculation about XRP hitting $50 or $100. He refused to rule it out completely, pointing to how Bitcoin reaching $100 once seemed impossible.

Schwartz argued that if serious investors truly believed XRP had even a 10% chance of hitting $100, they'd be buying heavily right now and the price would already be much higher than $1.60.

Image via X

Looking Ahead

Ripple's next move involves getting fully approved under the EU's new MiCA regulations. The company is pursuing a crypto-asset service provider license to align with those rules.

If approved, it would strengthen Ripple's position as a fully compliant operator in what's becoming one of the world's most regulated crypto markets.

For XRP holders, the question is whether regulatory wins will eventually translate into sustained price gains or if broader market conditions will continue to weigh on the token.