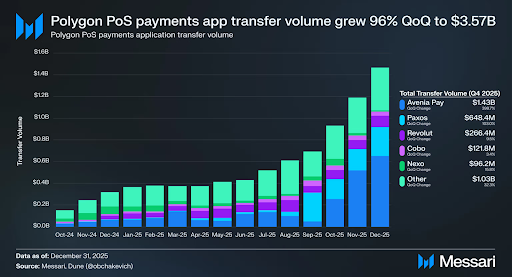

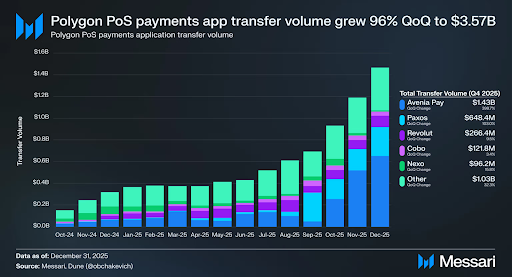

Polygon wrapped up the final quarter of 2025 with some interesting contradictions. While its token price took a beating, the network itself was busier than ever. Payment apps moved over $3.5 billion across the chain, and nearly a million people used them daily.

Image via Messari

If you're holding POL tokens in early 2026, you're probably wondering what all this activity means for your investment.

Here's what actually happened last quarter and why it matters.

Payment Volume Jumps Nearly 400% Year-Over-Year

Polygon processed $3.57 billion through payment applications in Q4—almost double what it handled the quarter before. Zoom out to the full year, and you're looking at a 399% increase.

So, what are the factors driving this?

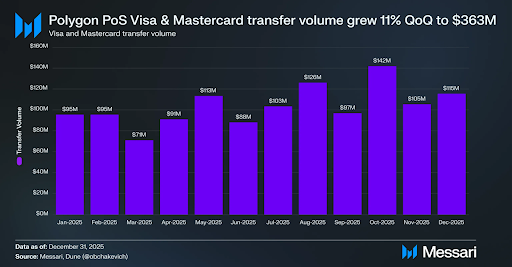

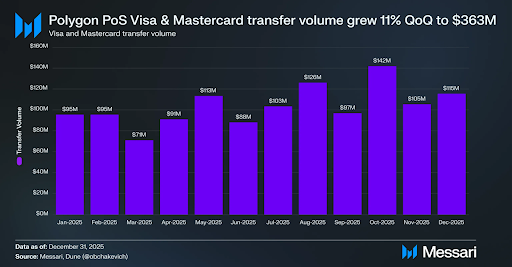

For starters, crypto cards are playing a major role in the recent performance. Ten different card programs processed $362.6 million in spending. Visa handled most of the volume at $266.4 million, with Mastercard picking up another $96.2 million.

Image via Messari

The network also recorded a number of notable partnerships:

- Revolut, which serves millions of users worldwide, now uses Polygon for stablecoin transfers

- Stripe lets businesses accept recurring payments in USDC through the network

- Flutterwave picked Polygon as its go-to blockchain for moving money across Africa

Not only that, when Mastercard launched its Crypto Credential program last quarter, Polygon was the first blockchain they plugged in. You can now send crypto using someone's username instead of a long wallet address, and it all settles on Polygon in the background.

Network Upgrades Push Polygon Toward 5,000 TPS

Polygon's developers shipped two major upgrades last quarter. The Rio hardfork went live in October, followed by Madhugiri in December. These upgrades changed how the whole network operates.

The biggest deal is something called instant finality. Before Rio, there was always a tiny chance your transaction could get reversed if the network reorganized its chain. Now transactions lock in almost immediately with zero reversal risk.

Madhugiri built on this by standardizing how fast blocks get produced—one second, every time. The network can now handle about 1,400 transactions per second, up from roughly 1,000 before.

But the real win is how they set things up for the future. Instead of needing big, risky upgrades to go faster, they can now just adjust settings. The path to 5,000 TPS is basically mapped out.

This matters more than you'd think. Banks and payment processors have zero tolerance for unreliable systems. If your blockchain occasionally hiccups or reverses transactions, they won't touch it.

Polygon is trying to be the blockchain that financial institutions can actually rely on, and these upgrades get them closer to that goal.

User Activity Surges Despite Price Weakness

All this growth is happening while POL's price is in the dumps. Nearly 931,000 addresses used Polygon daily in Q4—that's 57% more than the previous quarter.

Transaction volume hit 5.2 million per day. New users kept showing up too, with fresh addresses jumping 70% from Q3.

Stablecoins tell the same story. The network held $2.96 billion in stablecoins by year's end, with USDC alone reaching $1.34 billion. Polygon actually had more active USDC addresses than any other blockchain by the time the quarter wrapped up.

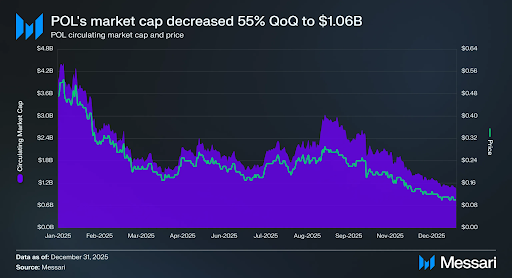

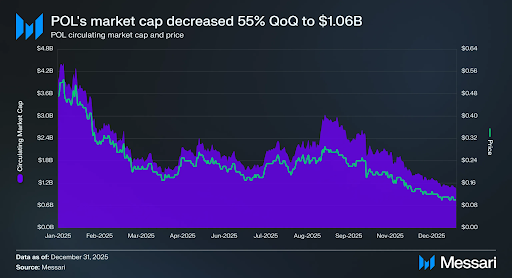

But POL got hammered. Its market cap fell 55% during Q4, dropping to $1.06 billion. Over the full year, it was down 78%. Meanwhile, the network it powers grew significantly.

Image via Messari

You'd think more users and more activity would push the token price up. Sometimes it works that way, but clearly not always. Lots of networks build huge user bases before their tokens capture any of that value.

The big question for anyone holding POL is whether this changes. Does Polygon eventually figure out how to turn all these payments and partnerships into demand for its token? Or does the network keep growing while the token just sits there?