Cryptocurrency markets are uniquely sensitive to news and events. A single tweet from an influential figure, a regulatory announcement, or a major technological breakthrough can send crypto prices soaring or crashing within minutes.

Understanding how to trade around these events—or whether to trade at all—is a critical skill that separates successful traders from those who get caught on the wrong side of volatile moves. This comprehensive guide will teach you how to identify significant news events, understand their potential impact, and develop effective strategies for news-driven trading on LBank.

Why News Moves Crypto Faster Than Traditional Markets

Unlike traditional financial markets, which operate during specific hours with circuit breakers and trading halts, cryptocurrency markets trade 24/7, with extreme volatility and immediate price reactions. This creates unique opportunities and dangers for news traders.

The impact of news in crypto differs fundamentally from that in traditional markets in several ways. The 24/7 trading environment means news can break at any time, including weekends and holidays, when liquidity might be lower and price swings more dramatic. The relatively smaller market capitalisation compared to traditional assets means that even moderately significant news can cause outsized price movements.

Social media amplification plays a massive role in crypto. A rumour on Twitter can move markets before traditional media even reports on it. The global nature of cryptocurrency means news from any country can impact prices instantly—a regulatory decision in South Korea or a mining ban in China affects the entire global market immediately.

Retail investor dominance in crypto markets means emotional reactions often outweigh rational analysis. Fear and greed drive more extreme moves than in institutional-dominated markets. Understanding these dynamics is essential for successful news trading.

Types of News Events That Move Crypto Markets

Not all news is created equal. Some events consistently create significant price movements, while others barely register. Understanding which categories matter most helps you focus your attention effectively.

Regulatory News represents one of the most impactful categories. Government announcements about cryptocurrency regulation, bans, or approval of crypto-related products can cause immediate and dramatic price swings. When China announced cryptocurrency mining bans in 2021, Bitcoin dropped over 50% in the following months. Conversely, approval of Bitcoin ETFs in various countries has consistently driven prices higher. Watch for announcements on the legal status of cryptocurrency in major economies, proposed or enacted legislation affecting crypto trading or mining, regulatory enforcement actions against exchanges or projects, and central bank digital currency developments that could affect the broader crypto ecosystem.

Macroeconomic Events increasingly influence cryptocurrency markets as institutional participation grows. Federal Reserve interest rate decisions, inflation data releases, employment reports, and geopolitical tensions all affect Bitcoin and altcoins, particularly as Bitcoin is increasingly viewed as a macro asset similar to gold. Major macroeconomic news now regularly moves crypto prices. Higher interest rates typically pressure Bitcoin lower as investors seek safer yields, while inflation concerns often drive Bitcoin higher as investors seek inflation hedges.

Exchange-Related News can cause immediate and severe price impacts, especially for the cryptocurrencies listed on those exchanges. Exchange hacks, bankruptcy announcements like FTX's collapse, new listing announcements, or delisting notices all create trading opportunities and risks. When a major exchange lists a new cryptocurrency, that coin often experiences a significant price pump. Conversely, security breaches or exchange failures can crash prices across the entire market as fear spreads.

Technology and Development News affects specific cryptocurrencies based on their progress and adoption. Major protocol upgrades like Ethereum's merge to proof-of-stake, successful testnets or mainnet launches, partnerships with major corporations, adoption by significant retailers or payment processors, and security vulnerabilities or successful hacks all create price volatility. Projects that deliver on technological promises tend to see sustained price appreciation, while those that miss deadlines or encounter technical problems often suffer.

Influential Figure Statements have outsized impacts in cryptocurrency markets. Tweets or statements from figures like Elon Musk, Michael Saylor, or major institutional investors can move markets dramatically. While this influence has diminished somewhat over time, it remains significant. During 2021, Elon Musk's tweets about Bitcoin and Dogecoin regularly caused 10-20% price swings within hours. Understanding which voices move markets and monitoring their communications can provide a warning of volatility.

Institutional Adoption News has become increasingly important as traditional finance enters crypto. Major banks offering crypto services, hedge funds allocating to Bitcoin, public companies adding Bitcoin to treasury reserves, and pension funds or sovereign wealth funds announcing crypto investments all tend to drive positive price momentum. MicroStrategy's regular Bitcoin purchases, Tesla's Bitcoin investment, and various institutional announcements have consistently created bullish price action.

IMAGE: by Author

How to Position Before Major Crypto News Breaks

Some news events are scheduled and announced in advance, allowing traders to position themselves before the event occurs.

Anticipatory Positioning involves taking positions before scheduled events based on expected outcomes. Federal Reserve meetings, scheduled protocol upgrades, anticipated regulatory decisions, and planned product launches all fall into this category. The key is identifying high-probability outcomes and positioning accordingly. If a cryptocurrency is scheduled for a major exchange listing, buying before the listing announcement might capture the subsequent price pump. However, this strategy carries risk—if the event disappoints or doesn't occur, the anticipated move may reverse sharply.

Reducing Risk Before Major Events is often the wisest approach for risk-averse traders. If major news is pending and the outcome is uncertain, reducing position sizes or moving to cash protects you from unexpected volatility. The "sell before the news" strategy recognises that uncertainty itself is risky. Many experienced traders reduce their exposure before major regulatory announcements, earnings reports from crypto-related companies, or contentious protocol upgrades where the outcome is genuinely uncertain.

Volatility Trading using options or futures allows you to profit from volatility itself rather than directional moves. Before major events, implied volatility often increases, making certain strategies profitable regardless of which direction the price moves. Straddle strategies, where you simultaneously hold long and short positions, can profit if the price moves dramatically in either direction following the news. However, these strategies require a sophisticated understanding of derivatives and carry their own risks.

Real-Time News Trading Strategies

When news breaks unexpectedly, your reaction speed and strategy determine whether you profit or lose.

The First Move Advantage belongs to those who see news first and react fastest. Set up news alerts from reliable sources, use social media monitoring for breaking developments, and keep trading platforms open during high-impact news periods. Twitter, Telegram channels focused on crypto news, and specialised crypto news aggregators can provide crucial seconds or minutes of advantage. However, speed without analysis is dangerous. The fastest reaction isn't always the correct one. News needs to be verified and interpreted before you risk capital.

Fade the Initial Reaction is a counterintuitive but often profitable strategy. Markets frequently overreact to news in the immediate aftermath, creating opportunities to trade against the initial move. If bad news causes a -20% crash within minutes, a bounce often follows as initial panic subsides and rational analysis begins.

This strategy works because emotional retail traders dominate the first minutes after news breaks, pushing prices to extremes. Professional traders then step in to buy the oversold condition or sell the overbought condition, causing a reversion. The key is distinguishing between genuine paradigm shifts and emotional overreactions. Not every crash bounces back—sometimes the initial move is just the beginning of a larger trend.

Wait for Confirmation is the most conservative approach. Rather than trading immediately, wait for the market to digest the news and establish a clear direction. This might mean missing the very first move, but it dramatically reduces the risk of getting caught in false moves or whipsaws. Look for price stabilisation after the initial volatility, volume confirmation supporting the move, and multiple timeframes aligning in the same direction before entering positions.

Scale Into Positions during news events rather than going all-in immediately. Enter with a small position to gain exposure, then add to it if your thesis proves correct and the move continues. This limits damage if you're wrong while still allowing participation if you're right.

IMAGE: by Author

Post-Event Analysis and Follow-Through Trading

The hours and days after major news often provide the best trading opportunities as the market fully digests the implications.

Understanding Sustained Moves vs. Temporary Spikes is crucial. Some news creates lasting changes to fundamentals that support sustained trends, while other news causes temporary volatility that quickly reverses.

Regulatory approval of Bitcoin ETFs, for example, represents a fundamental change that supports a sustained bull market. A celebrity mentioning Bitcoin on social media might cause a temporary spike, but it rarely supports lasting price changes.

Analyse whether the news changes the fundamental value proposition of the cryptocurrency, affects supply and demand dynamics, alters the regulatory or competitive landscape, or simply creates temporary excitement. Your trading horizon should match the likely duration of the news impact.

Trend Following After News works when significant news creates a new trend. If major positive news breaks Bitcoin out of a long consolidation range, the resulting uptrend might last weeks or months. Recognising these trend-starting events and positioning accordingly can be extremely profitable.

Use technical analysis to confirm the trend, look for higher highs and higher lows in uptrends, and ride the momentum while it lasts. Set trailing stop losses to protect profits while allowing the trend to continue.

Mean Reversion After Overreactions provides opportunities when markets have clearly overreacted. If a minor negative news item causes a -30% crash that seems disproportionate to the actual impact, a mean reversion trade betting on recovery can be profitable.

This requires judgment and experience to distinguish between overreactions that will reverse and genuine bad news that deserves a sharp price decline.

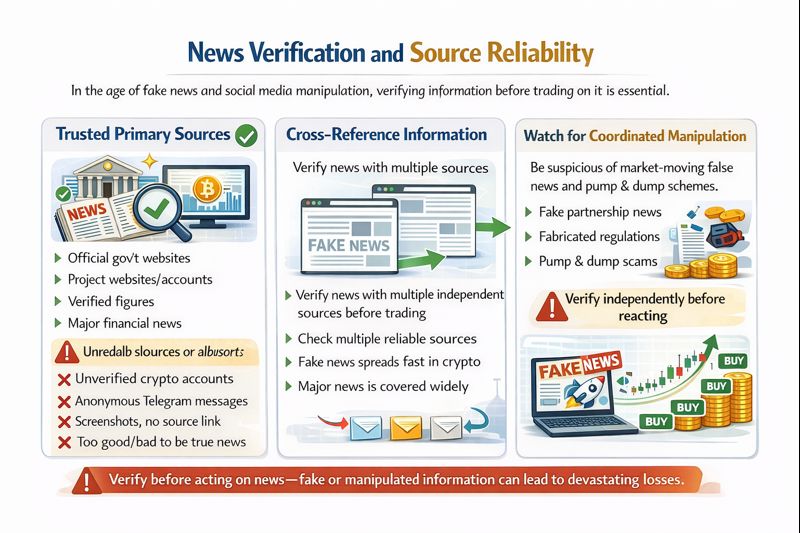

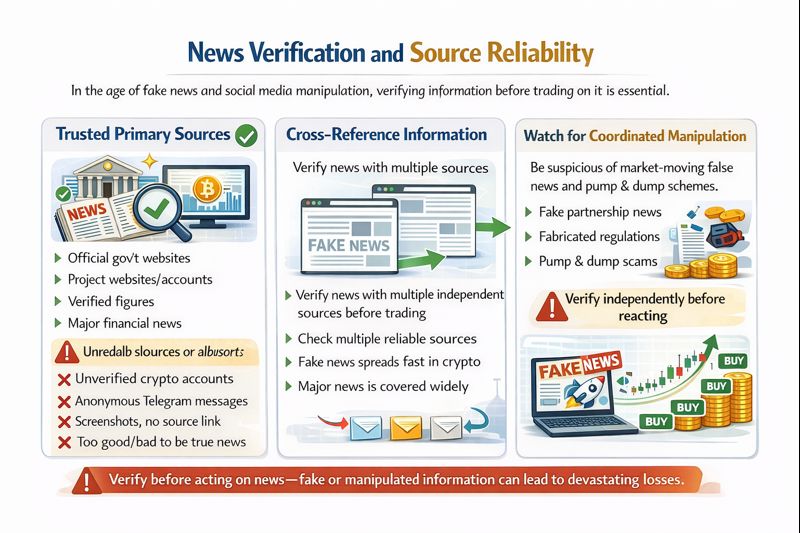

News Verification and Source Reliability

In the age of fake news and social media manipulation, verifying information before trading on it is essential.

Trusted Primary Sources should be your foundation. Official government websites for regulatory announcements, official project accounts and websites for development news, verified accounts of influential figures, and major financial news outlets with fact-checking processes all provide reliable information. Be extremely sceptical of unverified Twitter accounts, anonymous Telegram announcements, screenshots without links to sources, and news that seems too good or too bad to be true.

Cross-Reference Information before acting. If you see significant news on one source, verify it on at least two other independent sources before trading. Fake news spreads quickly in crypto, and trading on false information can be devastating. Major news will be reported by multiple outlets within minutes. If only one source is reporting something, wait for confirmation.

Watch for Coordinated Manipulation where false news is intentionally spread to move markets. Pump and dump schemes often involve fake partnership announcements or fabricated regulatory news. Sophisticated manipulators create fake websites, press releases, and social media buzz to lend credibility to false information. If news seems designed to create FOMO or panic, be extra cautious. Verify independently before reacting.

IMAGE: by Author

Turning News Trading Into a Repeatable System

Successful news trading requires systems and preparation rather than reacting randomly to whatever you happen to see.

Create a News Monitoring Infrastructure by setting up Google Alerts for keywords related to your holdings, following key crypto news accounts on Twitter with notifications enabled, joining Telegram groups focused on news and market analysis, and using news aggregator apps designed for cryptocurrency. Consider paid services that provide real-time alerts and analysis if you're serious about news trading. The cost can be justified by the advantages they provide.

Develop Response Protocols for different types of news. Before news breaks, decide how you'll react to various scenarios. If regulatory approval news breaks, what's your plan? If a major hack occurs, how will you respond? Having predetermined responses prevents emotional decision-making in the heat of the moment. Create checklists like verifying the news from multiple sources, assessing likely market impact, checking current position exposure, determining appropriate position size for the news trade, and setting stop losses before entering.

Maintain a News Trading Journal documenting what news occurred, how you traded it, what the outcome was, and what you learned. This record helps you identify which types of news you trade most successfully and which types consistently fool you. Review your journal regularly to refine your approach and avoid repeating mistakes.

Risk Management for News Trading

News trading carries unique risks that require special management approaches.

Never Risk More Than You Can Afford to Lose on any single news event. Markets can move violently and unpredictably around major news, potentially causing slippage that executes your orders at worse prices than expected. Use smaller position sizes for news trades than for regular technical trades. The additional volatility and uncertainty justify more conservative sizing.

Use Stop Losses Religiously, but place them carefully. During extreme volatility, prices can spike through your stop loss and execute at much worse levels than anticipated. Wide stops account for this possibility while still protecting you from catastrophic losses. Consider using stop limit orders rather than stop market orders to prevent execution at absurd prices during flash crashes, though be aware these might not execute if price gaps past your limit.

Avoid Trading During Maximum Uncertainty when news is breaking, but details are unclear. The minutes immediately after major news breaks are often the most dangerous, with wild price swings in both directions as the market tries to interpret what happened. Waiting even 5-10 minutes for more information can dramatically improve your risk-reward ratio.

Hedge Your Positions if you're holding significant positions and major news is pending. Opening a small opposite position or using options to protect your main holdings can limit damage if the news goes against you.

Common News Trading Mistakes

Understanding what not to do is as valuable as knowing what to do.

Overtrading News is perhaps the most common mistake. Not every news item deserves a trade. Many beginners trade every headline they see, generating transaction costs and taking unnecessary risks on low-impact news. Be selective. Only trade news that genuinely matters and where you have an edge in interpretation or timing.

Ignoring the Broader Context leads to trading news in isolation without considering the overall market environment. Positive news might not generate the expected rally if the broader market is in a strong downtrend. Negative news might not cause the expected crash in a strong bull market. Always consider the bigger picture before reacting to individual news items.

Trading on Rumors without confirmation destroys accounts. The old saying "buy the rumour, sell the news" works sometimes, but trading unconfirmed rumours is essentially gambling. Wait for official confirmation unless you're specifically implementing a rumour-trading strategy with appropriate risk management.

Revenge Trading After News Losses multiplies mistakes. If you lose money on a news trade, the natural impulse is to immediately trade again to recover. This emotional reaction usually leads to more losses. Accept the loss, review what happened, and wait for the next quality opportunity rather than forcing another trade.

News Trading in Bull vs. Bear Markets

News impact varies significantly depending on the broader market context.

Bull Market News Trading tends to see positive news amplified and negative news dismissed. Markets look for reasons to go higher, so even moderately positive news can trigger strong rallies. Conversely, bad news often gets bought as a dip opportunity rather than triggering sustained declines. In bull markets, focus on trading positive news and be cautious about shorting on negative news. The prevailing bullish sentiment often overcomes individual negative developments.

Bear Market News Trading shows the opposite dynamic. Markets interpret news through a pessimistic lens, amplifying negatives and ignoring positives. Even genuinely good news might trigger only brief rallies before the downtrend resumes. In bear markets, be selective about buying dips on positive news and more aggressive about trading negative news to the downside.

IMAGE: by Author

Tools and Resources for News Traders

Leveraging the right tools dramatically improves your effectiveness in news trading.

News Aggregators like CryptoPanic, CoinSpectator, and CoinDesk provide consolidated feeds of crypto news from multiple sources. These platforms help you avoid missing important developments.

Social Media Monitoring through TweetDeck or similar tools allows you to follow key accounts and hashtags. Set up columns for specific topics or individuals so you catch relevant tweets immediately.

Economic Calendars like those from Investing.com show scheduled economic announcements that might impact crypto markets. Knowing when major data releases occur helps you prepare.

On-Chain Analytics platforms like Glassnode or CryptoQuant provide data about actual blockchain activity that can confirm or contradict news narratives. If news suggests massive institutional buying, on-chain data should show large transactions to cold storage.

Alert Systems can be set up through Google Alerts, trading platform notifications, and specialised crypto alert services to notify you immediately when keywords or price levels are hit.

The Future of News Trading in Crypto

As cryptocurrency markets mature, news trading is evolving in ways that affect strategies.

Increasing Efficiency means news is incorporated into prices faster as more sophisticated traders and algorithms participate. The window for profitable news trading narrows as markets become more efficient.

Institutional Participation changes market dynamics. Institutional traders react differently from retail traders, often with deeper analysis and less emotion. This can reduce the magnitude of initial overreactions but also create more sustained moves when fundamentals genuinely change.

Regulatory Clarity in major markets might reduce the impact of regulatory news as the framework becomes established, but it will also create new categories of tradeable news around compliance and implementation.

AI and Algorithmic Trading increasingly dominate news trading, with algorithms that can read headlines, interpret sentiment, and execute trades in milliseconds. Human traders need to focus on interpretation and judgment rather than speed.

Final Takeaways on News Trading in Crypto

News trading in cryptocurrency markets offers significant opportunities for those who approach it systematically and carefully. The 24/7 nature of crypto markets, their sensitivity to news, and the emotional reactions of retail-dominated trading create volatility that skilled traders can exploit.

However, news trading also carries substantial risks. Price movements can be violent and unpredictable, fake news spreads quickly, and emotional reactions can overwhelm rational analysis. Success requires developing reliable information sources, creating systematic response protocols, implementing strict risk management, and maintaining emotional discipline even during chaotic market conditions.

Start your news trading journey on LBank by monitoring news without trading it initially. Watch how markets react to different types of news, identify patterns, and build conviction about which events create tradeable opportunities. When you do begin actively trading news, start with small positions and strict stop losses until you've proven your ability to navigate these volatile waters successfully.

Remember that the goal isn't to trade every news event, it's to identify the high-probability opportunities where you have an edge and trade only those while avoiding the rest. With patience, discipline, and systematic preparation, news trading can become a profitable component of your overall trading strategy.