Canada just dropped new crypto custody rules that are basically a direct response to getting burned badly five years ago. The country's investment regulator isn't taking any chances on seeing another QuadrigaCX-style meltdown that left thousands of investors with nothing.

What Just Changed

The Canadian Investment Regulatory Organization (CIRO) implemented its Digital Asset Custody Framework, effective immediately. The regulatory body explained on its website that the rules would allow them to take quicker action against emerging risks (including hacking, fraud, incompetent management and insolvency) that have caused large amounts of investor money to be lost over time.

CIRO (Canada's Investment Industry Regulatory Organization) has jurisdiction over all investment dealers and trading platforms in Canada; its new framework includes additional controls regarding custody (the physical custody and protection of digital currency by trading platforms on behalf of customers).

Lessons learnt from criminal enterprises and mismanagement of firms in the past have given rise to regulators indicating that there is a need for actions to prevent similar circumstances in the future. There are no references necessary to "QuadrigaCX" as Canadians are all aware of what transpired that has led to the development of these regulations; therefore the term "QuadrigaCX" does need to be referenced in this case.

The Disaster That Started It All

QuadrigaCX collapsed in 2019 after its founder, Gerald Cotten, supposedly died on a trip to India. The problem? He was allegedly the only person with access to the private keys controlling roughly $190 million in customer crypto.

The events of this case spiraled into so much speculation and conspiracy theory creation that customers lost their entire investments. Hartley still believes that Cotten's faked death was just an elaborate ruse to abscond with his customers’ funds, while others suspect simply lack of security measures caused the loss.

Whatever the truth, it exposed a glaring weakness in how Canadian crypto platforms operated. No proper key management, no backup access, no regulatory oversight of custody. Just "trust us with your money"—until that trust evaporated overnight.

Every platform failure since then gets measured against QuadrigaCX because it showed exactly how catastrophically wrong things can go when custody practices are garbage.

What Platforms Actually Have to Do Now

CIRO's framework eliminates the single points of failure that doomed QuadrigaCX. The technical requirements are spelled out in the official framework, but the core idea is simple: one person can never again control all access to customer funds.

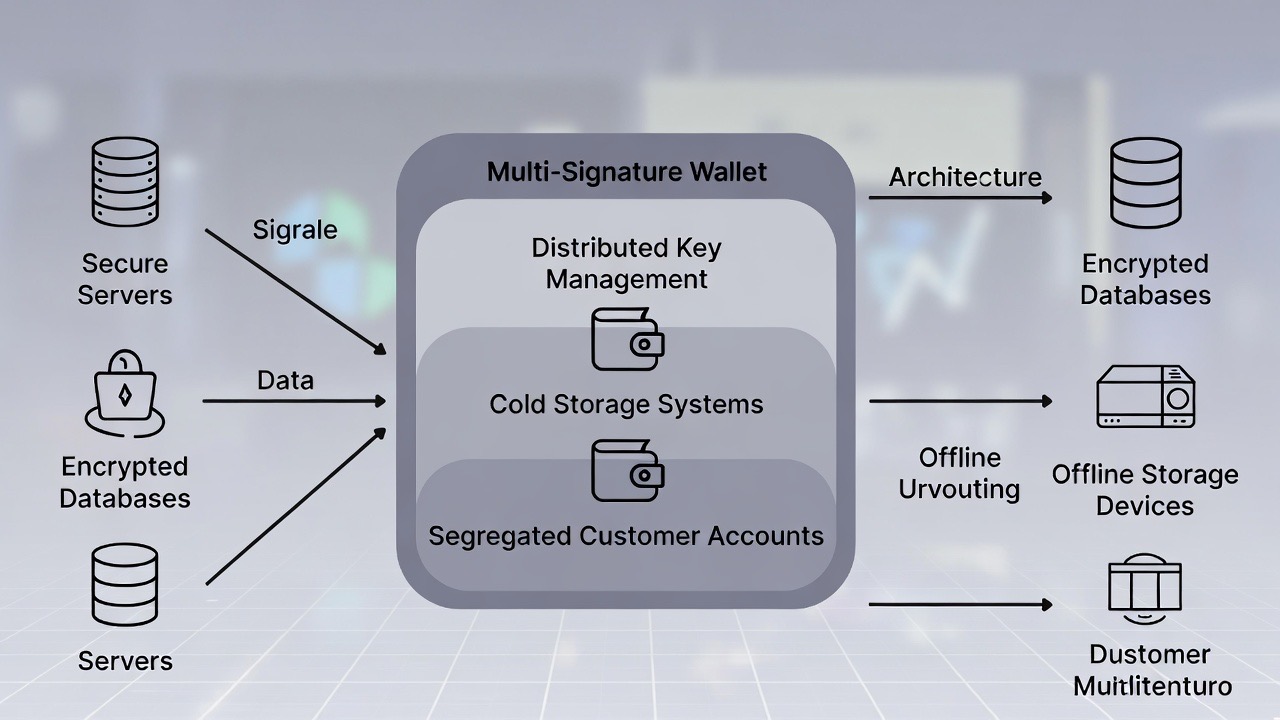

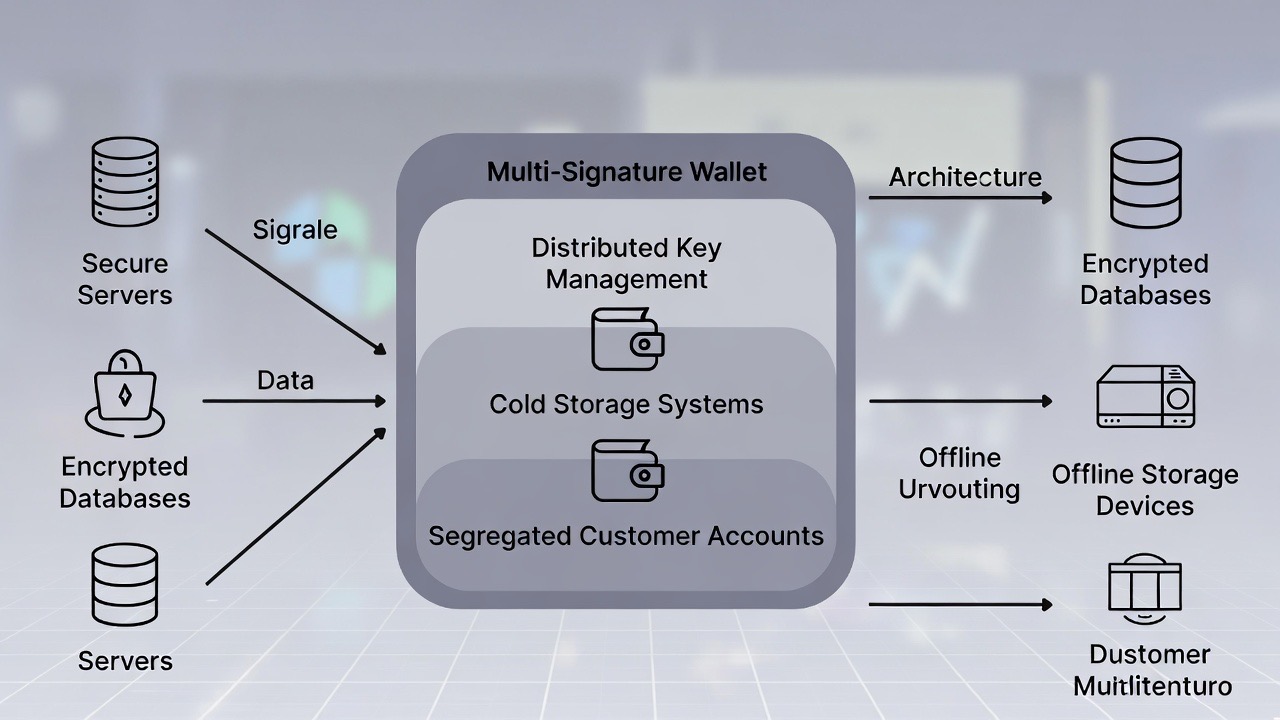

Platforms need stricter key management—think multi-signature wallets where multiple parties have to approve transactions. Requirements around cold storage and segregated accounts mean customer assets stay separate from company money.

Governance got beefed up too. Platforms need documented procedures, regular audits, and actual plans for what happens if key people become unavailable. Basic operational hygiene that should've been standard practice from day one but somehow wasn't.

Insurance and proof-of-reserves are also in the mix. Investors should be able to verify their assets actually exist and are properly secured, not just take some CEO's word for it.

Broader Impact

Canada's moving faster than most jurisdictions on this. Europe's got MiCA coming. The U.S. has a chaotic patchwork of state rules and federal enforcement but nothing comprehensive.

CIRO's approach is industry-led, which tends to produce more practical rules that don't get strangled by political dysfunction. It also means the industry can't really complain about regulators who don't understand crypto writing bad rules.

For platforms, compliance costs money. Upgrading infrastructure, implementing governance, getting audited—none of that's cheap. Smaller platforms might not survive the requirements, which could force consolidation.

Practically speaking, it should be easier for investors to maintain the integrity of their investments when utilizing digital currencies because the technology used to create them will help protect against losing coins due to hacking or fraud, as long as those protections actually get enforced instead of existing only in writing (i.e., an official document).

The Real Test Comes Next

New rules only matter if regulators enforce them. CIRO says the framework lets them respond faster to emerging risks, which suggests active monitoring instead of just investigating wreckage after disasters.

The real test hits when the next crisis comes—and there will be one. Crypto's too volatile and experimental for that not to happen.

What is significant is if CIRO finds issues early, acts before customers lose everything, and also holds platforms responsible for their mistakes. This is unlike the previous frameworks in that they existed but were unable to avoid catastrophe.

Bottom Line

QuadrigaCX happened over five years ago, and Canada's still fixing the regulatory mess it exposed. That's how much damage one spectacular failure does to trust and how long rebuilding credible oversight takes.

These custody rules won't eliminate crypto investment risk. Markets will still swing wildly, projects will still implode, people will still lose money on bad calls. But losing everything because an exchange founder dies with the only password? That shouldn't be possible anymore.

Whether this prevents the next QuadrigaCX depends on enforcement, platform compliance, and whether the framework catches whatever creative new failures crypto platforms inevitably discover.