The first month of 2026 has delivered a surprising twist in the ongoing debate between Bitcoin and gold as safe-haven assets. While many expected both assets to rally together during times of uncertainty, they've moved in opposite directions.

Gold has surged to unprecedented all-time highs above $5,600 per ounce, while Bitcoin has struggled, falling from around $96,000 in early January to below $72,000 as of early February. This divergence offers crucial insights into how these two assets function in modern portfolios and which might better serve your investment goals on LBank's trading platform.

2026’s Reality: Two Assets, Very Different Stories

As of late January 2026, the contrast between Bitcoin and gold couldn't be starker. Gold has broken through the psychological $5,000 barrier for the first time in history, trading around $5,268 per ounce and posting gains of over 18% year-to-date. The precious metal has gained more than $2,300 per ounce compared to a year ago, with major investment banks like Goldman Sachs raising their year-end 2026 target to $5,400 per ounce.

Meanwhile, Bitcoin has experienced a challenging start to the year. After briefly touching $96,000 in early January, the cryptocurrency has since traded between $72,000 and $92,000, representing a drop of approximately 30% from its October 2025 all-time high of $126,000. Bitcoin spot ETFs have experienced over $1.3 billion in cumulative outflows over the past week, signalling reduced institutional appetite for the digital asset.

This divergence highlights a critical reality: Bitcoin and gold, while both often labelled as alternatives to traditional fiat currencies, behave very differently during periods of market stress and uncertainty.

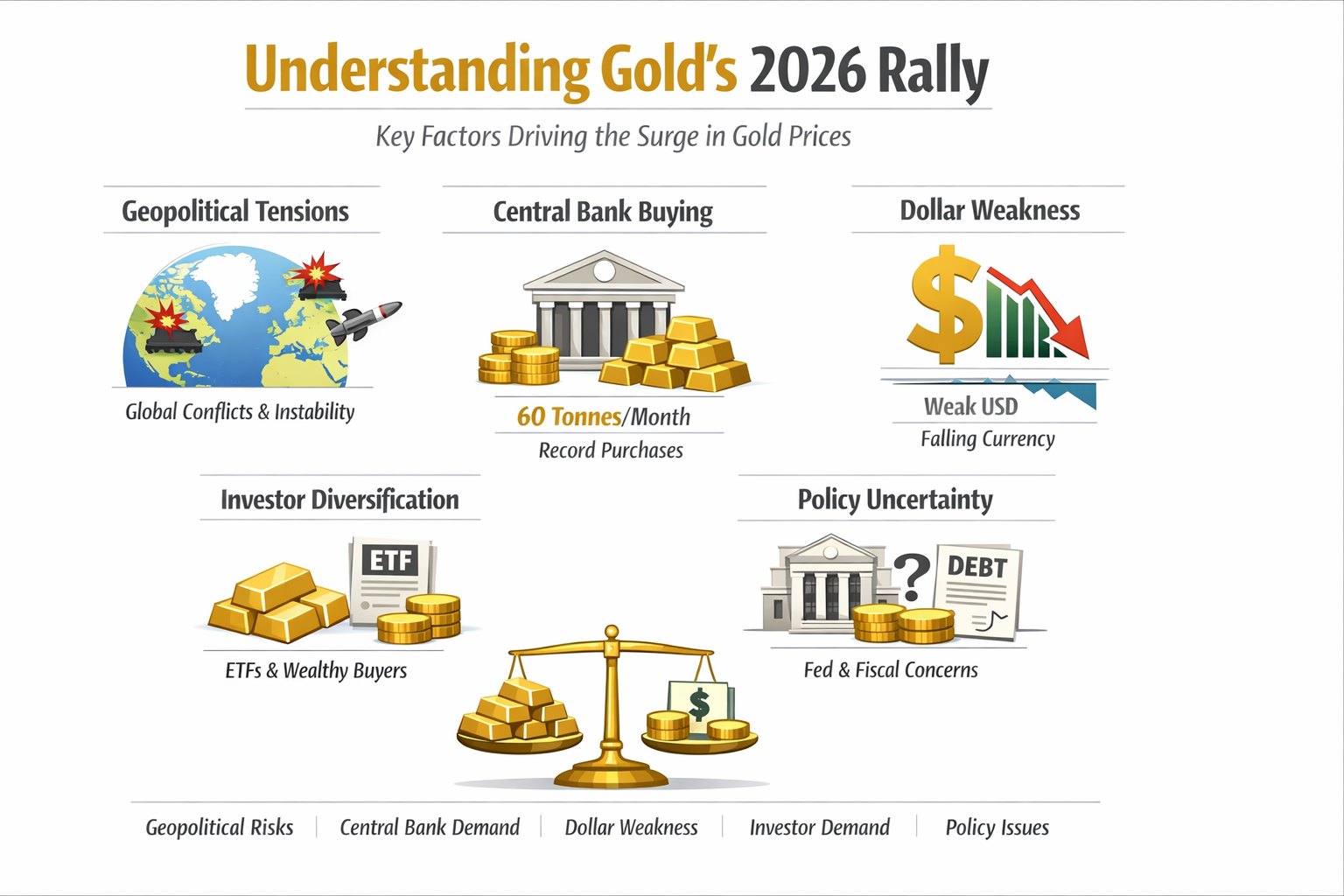

Understanding Gold's 2026 Rally

Gold's spectacular performance in early 2026 isn't happening in a vacuum; it's being driven by a confluence of powerful factors that are reinforcing its traditional role as the ultimate safe-haven asset.

Geopolitical Tensions have emerged as a primary driver. Recent flashpoints from Greenland and Venezuela to the Middle East have underscored higher geopolitical risk, reinforcing gold's appeal as a hedge against uncertainty. President Trump's threats regarding Greenland, tariff warnings against European allies, and escalating tensions with Iran have all contributed to heightened risk perceptions that typically favour gold.

Central Bank Buying continues at unprecedented levels. Goldman Sachs estimates central bank purchases are now averaging around 60 tonnes per month, far above the pre-2022 average of 17 tonnes. Emerging market central banks, in particular, are diversifying away from dollar-denominated assets, creating structural demand that supports higher gold prices regardless of short-term market movements.

Dollar Weakness has accelerated gold's ascent. The U.S. dollar index has fallen to its weakest level since September, partly due to coordinated interventions by the Federal Reserve and Bank of Japan in currency markets. A weaker dollar makes gold more attractive to international buyers and reduces the opportunity cost of holding non-yielding assets.

Investor Diversification beyond traditional channels has broadened gold's demand base. Western ETF holdings have climbed by about 500 tonnes since the start of 2025, while physical purchases by high-net-worth families have become an increasingly important source of demand. This diversification of buyers creates more stable, sustained demand.

Policy Uncertainty surrounding Federal Reserve independence and U.S. fiscal sustainability has driven safe-haven demand. Concerns about potential political interference with the Fed, combined with questions about the long-term sustainability of U.S. debt, have reinforced gold's role as insurance against monetary debasement.

IMAGE: by Author

Why Bitcoin Has Struggled in Early 2026

Bitcoin's underperformance relative to gold reveals important truths about how the cryptocurrency functions during periods of uncertainty—lessons that all crypto traders should understand.

The Liquidity Paradox has become apparent. Bitcoin's always-on trading, deep liquidity, and instant settlement make it an easy asset to offload when investors need to raise cash quickly. Rather than acting as a safe haven during stress, Bitcoin has become what analysts call an "ATM"—the first asset investors sell when they need liquidity. This behaviour pattern directly contradicts the "digital gold" narrative that has long supported Bitcoin's valuation.

Institutional Repositioning has exerted significant selling pressure. The concentrated nature of recent ETF outflows, with three major Bitcoin ETF products accounting for approximately 92% of total exits, suggests large institutional allocators are reducing exposure rather than retail panic selling. These sophisticated investors appear to be rotating capital from Bitcoin into other assets, including the surging precious metals market.

Federal Reserve Policy has created headwinds. While many Bitcoin enthusiasts expected falling interest rates to boost the cryptocurrency, the Fed remains divided, leading traders to price in 'higher for longer' rates, which typically strengthens the dollar and weighs on Bitcoin. When rates remain elevated, safer assets like Treasury bonds become more attractive compared to volatile assets like Bitcoin.

Derivatives-Driven Volatility has undermined confidence. Bitcoin's advance toward $96,000 was largely 'mechanically' driven by derivatives flows, including short liquidations, rather than by sustained spot accumulation. When this forced buying pressure faded, prices quickly reversed, highlighting the fragility of rallies not supported by genuine demand.

Regulatory Uncertainty continues to weigh on sentiment. Despite expectations of a more crypto-friendly regulatory environment under the Trump administration, delays in passing the proposed Clarity Act and concerns about a potential government shutdown have kept institutional investors on the sidelines.

Long-Term Holder Selling has created a supply overhang. On-chain data shows that vintage coins are continuing to move toward exchanges, suggesting a steady stream of selling from long-term holders who accumulated at lower prices. This contrasts sharply with gold, where large holders, particularly central banks, continue to accumulate.

IMAGE: by Author

The Safe-Haven Test: Gold Passes, Bitcoin Fails

The divergence between Bitcoin and gold in early 2026 provides a real-world test of their respective safe-haven credentials, and the results are unambiguous.

Since January 18, after Trump first threatened tariffs in his push for Greenland acquisition, Bitcoin has lost 6.6% of its value, while gold has moved up 8.6% to new highs near $5,000. This nearly 15% performance gap during a period of heightened geopolitical uncertainty demonstrates that markets view these assets very differently when seeking safety.

The distinction comes down to the type of uncertainty each asset hedges against. Gold excels in moments of immediate confidence loss, war risk, and fiat debasement that does not involve a full system break. It's the asset investors' turn to when they need stability now, during the current crisis.

Bitcoin, by contrast, appears better suited to longer-term concerns about systemic monetary failure or sovereign debt crises that unfold over years or decades. The current turbulence, driven by tariffs, policy threats, and short-term geopolitical shocks, doesn't trigger Bitcoin's safe-haven premium—it triggers selling as investors flee to more established stores of value.

Fundamental Differences: Why They Behave Differently

Understanding why Bitcoin and gold respond differently to market conditions requires examining their fundamental characteristics.

History and Trust separate these assets significantly. Gold has served as money and a store of value for over 5,000 years. It's recognised across all cultures and geographies, held by every major central bank, and deeply embedded in the global financial system. This multi-millennial track record creates profound trust that can't be replicated quickly. Bitcoin, while revolutionary, is only 16 years old. It hasn't weathered multiple complete economic cycles, major wars, or systemic financial crises. This lack of historical performance data during various stress scenarios makes institutional investors hesitant to rely on it as their primary safe haven.

Volatility and Stability profiles differ dramatically. Gold's price movements are typically measured, even during rallies. A 2-3% daily move in gold is considered significant. This stability makes it suitable for conservative institutional portfolios and central bank reserves. Bitcoin's volatility remains extreme by comparison. Daily swings of 5-10% are common, and 20-30% moves within weeks are not unusual. This volatility makes Bitcoin unsuitable for many institutional mandates and conservative investors who need stability above all else.

Regulatory and Custodial Framework advantages favour gold. The systems for storing, insuring, and regulating gold are mature and well-established globally. Central banks, pension funds, and conservative institutions know exactly how to custody gold within their existing frameworks. Bitcoin's regulatory status remains evolving, and custody solutions, while improving, haven't achieved the institutional comfort level of gold. Questions about regulatory classification, tax treatment, and custody security continue to create friction for large-scale institutional adoption.

Supply Dynamics work differently for each asset. Gold's supply grows slowly and predictably, approximately 1-2% annually through mining. This steady expansion is well-understood and factored into valuations. Bitcoin's supply is algorithmically determined, with periodic halvings reducing new issuance. While the 21 million coin cap is attractive to some investors, the relative novelty of this monetary policy and uncertainty about how markets will respond to future halvings create unknown variables that some institutional investors find uncomfortable.

IMAGE: by Author

Investment Characteristics: Strengths and Weaknesses

Each asset offers distinct advantages and disadvantages that suit different investment objectives and risk profiles.

Gold's Strengths include proven safe-haven status during crises, low correlation with equities providing genuine diversification, central bank buying creating structural demand, physical permanence and universal recognition, and mature regulatory and custody frameworks making it institutionally acceptable.

Gold's Weaknesses include no yield or income generation, expensive storage and insurance costs for physical holdings, slower price appreciation historically compared to growth assets, and limited upside potential given its already massive market capitalisation exceeding $15 trillion.

Bitcoin's Strengths include potential for exponential price appreciation, easy transferability and divisibility, fixed supply cap of 21 million coins creating scarcity, 24/7 trading and global accessibility, and increasing institutional adoption and infrastructure development.

Bitcoin's Weaknesses include extreme volatility, creating significant short-term risk, regulatory uncertainty across jurisdictions, vulnerability to selling during liquidity crises, technology risks, including quantum computing threats, network security concerns, and no cash flow or intrinsic value floor, unlike dividend-paying stocks or income-producing real estate.

Portfolio Allocation Strategies for 2026

Given the different characteristics and recent performance of Bitcoin and gold, how should traders and investors approach allocation decisions?

Risk Profile Assessment should be your starting point. Conservative investors seeking capital preservation and stability should allocate more heavily to gold, potentially 5-10% of total portfolio value. Gold's proven safe-haven characteristics make it suitable for risk-averse profiles and retirement portfolios.

Moderate risk investors can benefit from holding both assets. A balanced approach might include 3-5% in gold for stability and 2-3% in Bitcoin for growth potential. This combination provides some downside protection while maintaining exposure to Bitcoin's upside.

Aggressive investors comfortable with volatility might weight more heavily toward Bitcoin, potentially a 5-10% allocation or higher, while still maintaining some gold (2-3%) as portfolio insurance. This approach maximises growth potential but requires strong emotional discipline during Bitcoin's inevitable drawdowns.

Time Horizon Matters significantly. Short-term traders (days to months) should recognise that Bitcoin's volatility creates both opportunity and risk. Gold's more stable price action makes it better suited for conservative short-term positioning, especially during uncertain periods.

Medium-term investors (months to years) can benefit from both assets but should recognise that Bitcoin's four-year halving cycle creates distinct opportunity windows. Gold's steadier appreciation makes it more predictable for medium-term planning.

Long-term investors (years to decades) might favour Bitcoin's appreciation potential while using gold as a stabiliser. Over sufficient time horizons, Bitcoin's supply dynamics and network effect potential could drive substantial value creation, but gold provides the stability to weather Bitcoin's inevitable bear markets.

Current Market Environment considerations for 2026 suggest caution with Bitcoin and an opportunity with gold. The technical setup favours gold continuation toward $5,400-$6,000 as forecasted by major banks, while Bitcoin faces resistance and may need to consolidate between $85,000-$95,000 before establishing a new trend.

Given the persistent geopolitical tensions and policy uncertainty, gold's safe-haven premium appears justified and sustainable. Bitcoin may need to wait for clearer regulatory frameworks and economic conditions before resuming its bull market.

Diversification Benefits arise from holding both assets despite their different performance patterns. In portfolios, gold and Bitcoin together can protect against different types of risks: gold against immediate geopolitical and economic shocks, and Bitcoin against long-term monetary debasement and systemic currency failure.

Trading Strategies on LBank for Each Asset

Practical trading approaches for Bitcoin and gold differ based on their distinct characteristics.

For Bitcoin Trading on LBank, consider the current volatility and range-bound action. Range trading between key support at $85,000-$88,000 and resistance at $94,000-$96,000 offers opportunities for swing traders. Use appropriate position sizing given Bitcoin's volatility—smaller positions than you'd use for less volatile assets. Breakout trading could become relevant if Bitcoin breaks decisively above $96,000 or below $84,000. Wait for volume confirmation before entering directional trades. The current consolidation could be building energy for a significant move in either direction.

For futures traders, funding rates and market sentiment indicators become crucial. Monitor ETF flows, long-term holder behaviour, and derivatives positioning for clues about institutional sentiment.

For Gold Exposure through crypto-backed gold tokens or gold-tracking assets, traders can benefit from gold's uptrend with the convenience of cryptocurrency infrastructure. Dollar-cost averaging into gold exposure makes sense given the strong fundamental backdrop and favourable technical setup. Trend following strategies work well with gold's more stable price action. Moving average crossovers and trend indicators generate clearer signals than with Bitcoin's choppier price action.

Combined Strategies might include using gold positions as portfolio stabilisers while taking more aggressive positions in Bitcoin when clear opportunities arise. During periods of uncertainty, increasing gold exposure while reducing Bitcoin position sizes protects capital while maintaining some cryptocurrency exposure.

The Future Outlook: What Comes Next?

Looking ahead through 2026 and beyond, several factors will influence the relative performance and appeal of Bitcoin versus gold.

Regulatory Developments will be crucial for Bitcoin. Passage of the Clarity Act or similar comprehensive cryptocurrency legislation could remove a major overhang and attract institutional capital currently sitting on the sidelines. Conversely, harsh or unclear regulations could extend Bitcoin's consolidation phase.

Macroeconomic Conditions will affect both assets, but in different ways. If inflation re-accelerates, both could benefit, though gold has proven more reliable in this scenario. If a recession emerges, gold would likely outperform as the traditional safe haven. In a "goldilocks" scenario of stable growth and falling rates, Bitcoin might finally realise its growth potential.

Geopolitical Evolution of current tensions around Greenland, tariffs, and Iran will continue to influence gold. As long as these uncertainties persist, gold's safe-haven bid should remain strong. Resolution of these issues could see gold consolidate gains while risk appetite returns to assets like Bitcoin.

Technological Developments for Bitcoin, including Lightning Network adoption, layer-2 solutions, and improved custody services, could enhance Bitcoin's utility and institutional appeal. Gold faces no comparable technological evolution, but also faces no technological risks.

Generational Wealth Transfer favours Bitcoin over time. Younger investors show a stronger preference for digital assets over physical gold. As wealth transfers to millennials and Gen Z over the coming decades, this demographic shift could support Bitcoin's long-term value proposition, even if it doesn't help short-term performance.

IMAGE: by Author

Common Misconceptions to Avoid

Several myths persist about Bitcoin and gold that investors should understand.

Myth: Bitcoin has replaced gold as a safe haven. Reality: Early 2026 definitively proved this false. Bitcoin reacts more like a technology stock than digital gold during market stress.

Myth: Gold can't keep rallying from current levels. Reality: Gold's strong fundamentals, including central bank buying, geopolitical risk, and policy uncertainty, support continued strength. Major banks forecast $5,400-$6,000 by the end of 2026.

Myth: You must choose between Bitcoin and gold. Reality: They serve different purposes and hedge different risks. Many successful investors hold both in appropriate proportions.

Myth: Gold is outdated "boomer" money. Reality: Gold's recent outperformance and continued central bank accumulation demonstrate its enduring relevance in modern portfolios.

Myth: Bitcoin's fixed supply makes it superior to gold. Reality: While Bitcoin's supply cap is attractive in theory, gold's slowly expanding supply hasn't prevented it from serving as an effective store of value for millennia. What matters more is demand relative to supply, not just absolute supply limits.

Making Your Decision

Choosing between Bitcoin and gold, or determining the right allocation to each, depends on your individual circumstances, goals, and current market conditions.

Choose Gold as Your Primary Safe Haven if: you prioritise capital preservation over growth, you need stability and can't tolerate high volatility, you're investing for retirement or other goals requiring predictability, the current geopolitical environment concerns you, or you want an asset with proven safe-haven performance across centuries.

Choose Bitcoin as Your Primary Holding if: you have a long time horizon and can weather significant volatility, you believe in cryptocurrency's technological revolution and adoption trajectory, you're comfortable with the regulatory uncertainties and evolving infrastructure, you seek potentially exponential returns and are willing to accept corresponding risk, or you want to hedge against long-term fiat currency debasement.

Consider Holding Both if: you want diversified protection against different types of risks, you have a balanced risk profile seeking both stability and growth, you appreciate that each asset has distinct correlation patterns with traditional portfolios, or you want flexibility to adjust allocations as market conditions evolve.

Final Thought on Gold and Bitcoin Comparison

The divergent performance of Bitcoin and gold in early 2026 provides valuable lessons for all investors and traders. Gold's surge to record highs above $5,200 while Bitcoin struggles below $90,000 demonstrates that these assets, despite both being positioned as alternatives to fiat currency, serve fundamentally different roles in portfolios.

Gold has proven its safe-haven credentials once again, attracting capital during periods of geopolitical tension, policy uncertainty, and market stress. Its millennia-long track record, central bank accumulation, and mature institutional framework make it the reliable choice for capital preservation.

Bitcoin, while offering revolutionary technology and potential for substantial appreciation, hasn't yet earned the safe-haven status many advocates claim. Its vulnerability to selling during liquidity crises and correlation with risk assets during stress periods reveal that it functions more like a high-beta technology investment than digital gold—at least for now.

For traders on LBank's platform, the optimal approach likely involves holding both assets in proportions appropriate to your risk tolerance and goals. Gold provides the stability and proven safe-haven characteristics that protect portfolios during turbulent times, while Bitcoin offers the growth potential and technological innovation that could drive substantial returns over longer timeframes.

As we move through 2026, watch for Bitcoin to find a sustainable floor and potentially resume its growth trajectory once regulatory clarity improves and risk appetite returns. Meanwhile, gold's strong fundamentals suggest its rally could extend further, making it worthy of continued allocation despite already being at all-time highs.

The ultimate answer to "Bitcoin or gold?" isn't binary—it's "both, in the right proportions for your situation." Understanding how each asset functions, what drives their prices, and when they perform best will help you construct a resilient portfolio capable of weathering any market environment.